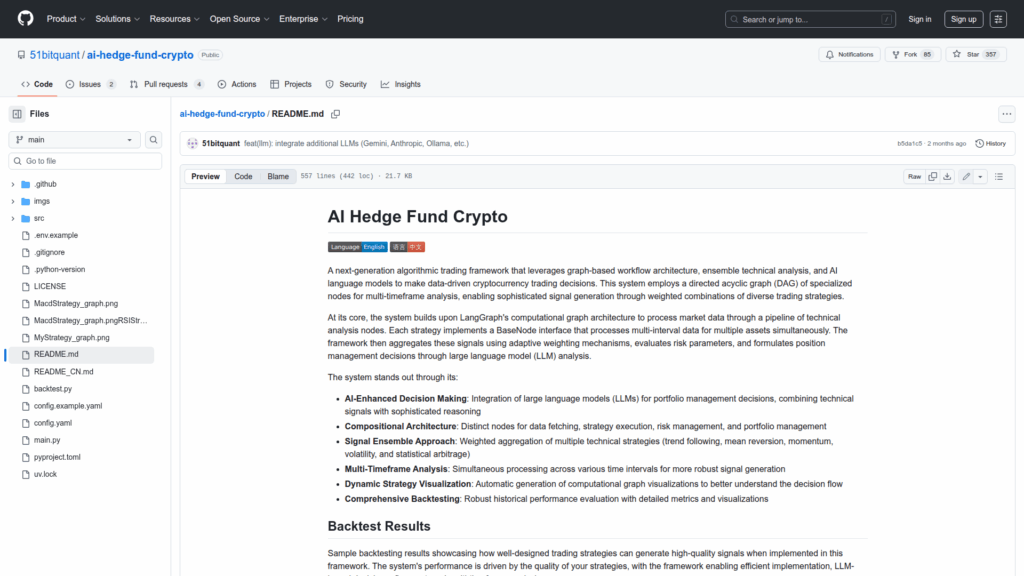

ai-hedge-fund-crypto

Basic Information

This repository provides an algorithmic trading framework focused on cryptocurrency markets that combines technical analysis, a directed acyclic graph workflow, and large language model reasoning to generate and evaluate trading signals. It is built around LangGraph-style computational graphs where modular nodes perform data fetching, multi-timeframe processing, strategy execution, risk evaluation, and portfolio decisioning. The system supports both backtesting and live analysis modes, is configurable via a central config.yaml and environment variables, and is designed to run with Python 3.9+ (Python 3.12 recommended) using the uv toolchain. It integrates with Binance for market data and planned order execution and supports multiple LLM providers for decision refinement. The repo also includes tooling for visualizing the computational graph, caching market data, running comprehensive backtests, and adding custom strategy modules.