Deferred

App Details

Website

Who is it for?

Deferred can be useful for the following user groups:., Real estate investors., Property sellers., Individuals or businesses conducting 1031 exchanges

Description

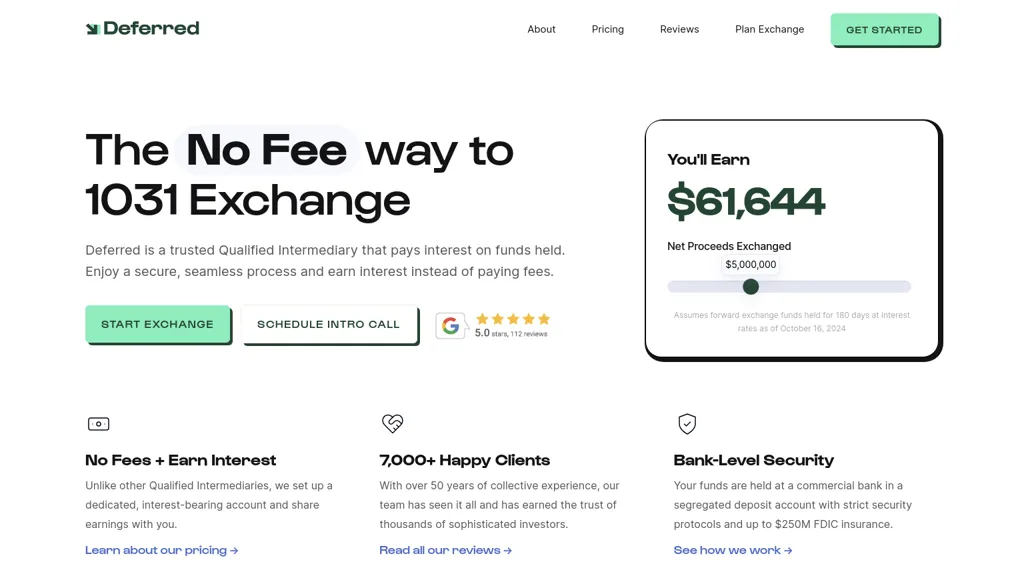

Deferred is a qualified intermediary service designed for 1031 exchanges that allows users to earn interest on their exchange funds while avoiding traditional fees. The platform ensures a secure and transparent process by holding funds in dedicated, interest-bearing accounts at leading banks with FDIC insurance coverage of up to $250 million. With a focus on client safety, Deferred utilizes multi-factor authentication and advanced data encryption to protect personal financial information. Additionally, the service is backed by a team with over 40 years of combined experience in handling 1031 exchanges, offering clients expertise without the burden of hidden costs.

Technical Details

Use Cases

✔️ Utilize Deferred to execute 1031 exchanges while earning interest on funds, significantly reducing the amount paid in traditional fees, ensuring a more profitable investment transition., ✔️ Leverage Deferred"s secure and transparent platform for handling exchange funds, providing peace of mind with FDIC insurance coverage and advanced encryption for personal financial information., ✔️ Access expert guidance backed by 40 years of combined experience in 1031 exchanges through Deferred, simplifying the process and capitalizing on expert insights without hidden costs.

Key Features

✔️ Qualified intermediary service., ✔️ Interest-bearing accounts., ✔️ FDIC insurance coverage., ✔️ Multi-factor authentication., ✔️ Advanced data encryption.

Monetization

Pricing Model

Review

Write a ReviewThere are no reviews yet.