Kick

App Details

Description

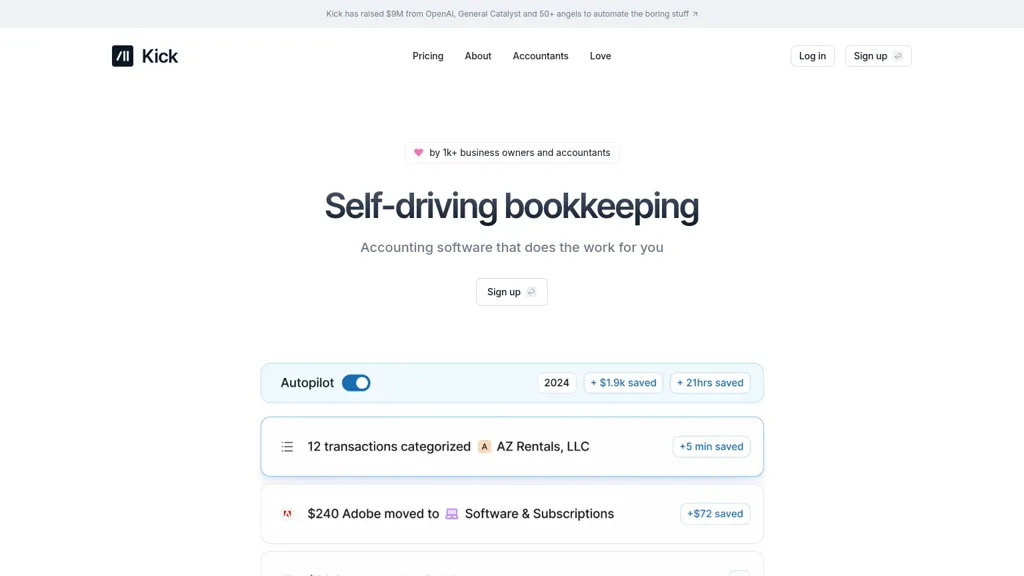

Kick is a self-driving bookkeeping tool designed to streamline financial management for business owners and accountants. It automates the categorization of transactions in real-time, ensuring expert accuracy in financial reporting and allowing users to focus on more strategic tasks. Kick personalizes actions through customizable rules, adapting to unique business needs while also providing insights into income and spending across multiple accounts and entities. Users benefit from tax-ready financials, including profit and loss statements and balance sheets, which makes collaboration with tax advisors and CPAs efficient. With its user-friendly interface, Kick simplifies the onboarding process and facilitates a smooth transition from other accounting platforms. This system also automatically manages intercompany transactions, making it suitable for modern businesses looking to enhance their financial hygiene.

Technical Details

Links

Monetization

Review

Write a ReviewThere are no reviews yet.